9 Soft Sales Skills Every Salesperson Should Know

Soft sales skills are interpersonal capabilities that allow reps to connect and develop strong relationships with prospects and customers. Things like resilience and emotional intelligence help build trust, making them especially useful skills in a sales position. We’ll discuss these developable traits and other key soft skills like them to help you generate, qualify, and nurture leads in order to convert more opportunities into won deals.

1. Resilience

One of the most common things sales reps experience when selling is rejection. No matter how skilled or experienced you are in sales, you will lose more opportunities than you will win. With that said, one difference between successful vs unsuccessful sales reps is their ability to pick themselves back up and focus on the next deal—otherwise known as resilience.

Resilience also includes the mindset of keeping in contact with leads even after a rejection. Statistically, 44% of sales reps give up after one no, 22% after two, and 14% after three, with the average number of contacts before a “yes” being five. Pushing yourself to not give up on opportunities and always keeping your head up is a trait worth having that will set you ahead of most of your competition.

This skill is mostly psychological and takes a certain thought process to develop. Always remain positive no matter how bad of a slump you’re in and remember that every “no” you get is just one step closer to your next “yes.”

2. Emotional Intelligence

Emotional intelligence is the ability to understand your emotions as well as how someone is feeling so you can adapt accordingly. Obviously, this is important in sales because you need to know when to exhibit certain traits such as empathy, confidence, or reassurance based on what the prospect expresses. Plus, a customer often makes purchases based on feeling rather than logic, making it far easier to close if you can read the room to employ emotional selling.

This soft skill is often naturally developed by socializing with others from an early age. You can, however, learn this skill through online courses, videos, and case studies. You can also take tests to measure your emotional intelligence and which particular areas need improvement. Many reps also find that working in sales and constantly collaborating with others can boost this trait organically.

3. Empathy

The importance of this soft sales skill is rooted in the fact that only 3% of the population consider salespeople to be trustworthy. They have a perception that sales reps only care about finalizing the deal despite whether it’s truly in the best interest of the customer. This is why the ability to put yourself in another’s shoes and fully understand where they are coming from is a notable factor in building trust.

Practice this trait by constantly framing questions out of genuine curiosity and repeating back things a prospect says in an acknowledging way. For example, they might have a certain pain point, such as their current provider being too expensive. There, you can repeat back something like, “I totally understand where you’re coming from, there’s nothing more frustrating than feeling like you aren’t getting the value for what you paid for.”

The ability to express empathy proves you are genuine in trying to help them by knowing exactly what it’s like from their point of view. It becomes easier to help a customer when they can trust you and perceive that your interest is to help them solve their unique problems and not just to make the sale.

4. Problem-solving

Problem-solving refers to the ability to find solutions to current and future issues that might come up. In the context of sales, a rep needs to be proactive on things that might slow down the sales process. For example, suppose a sales rep understands there will be multiple decision-makers required to finalize a sales deal. In that case, they can be proactive and ask all of them to be on the call for the initial presentation or product demo to solve that problem.

This skill also refers to helping a prospect achieve their goals or mitigate specific issues they currently have. For instance, let’s say you sell automation technology and know your prospective client is interested but would like to slowly implement it team-by-team rather than all at once. You might propose the best course of action is to start with a freemium plan and slowly upgrade until they are fully comfortable subscribing to a premium plan.

Many problem-solving skills come with experience in identifying issues and their root causes, and then providing potential courses of action. Problem-solving looks different depending on the person or group of people you’re trying to help and the flexibility you have for proposing creative and custom solutions for yourself, a team member, or a potential customer.

5. Adaptability

The ability to adapt quickly is crucial in sales because buyer preferences and the selling landscape are constantly evolving, and sales reps must change with it. For instance, “social selling” has become popularized fairly recently as reps now generate leads and new business through social media platforms such as LinkedIn. For many, this has replaced or supplemented traditional activities such as cold calling or emailing to connect with leads.

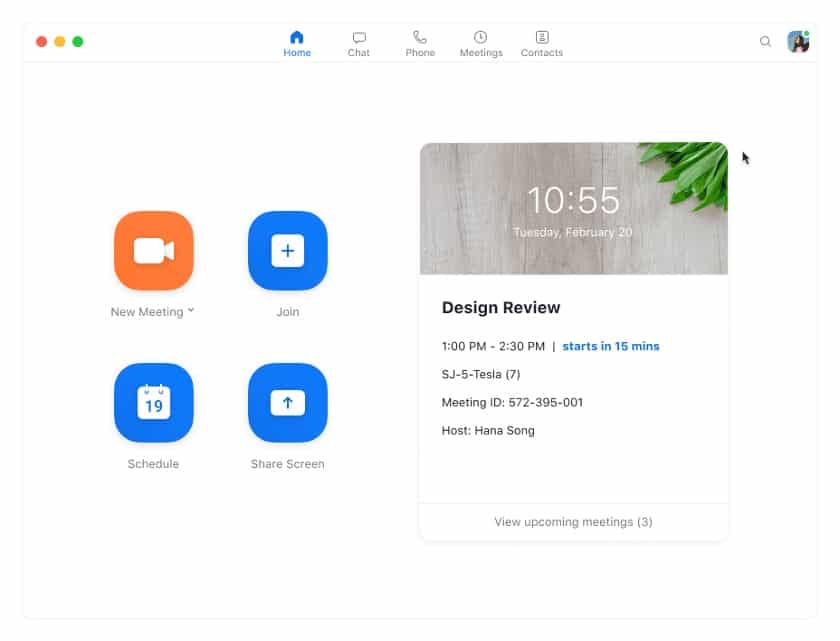

Even more recently, one of the ways COVID-19 changed sales was that reps had to adapt to the communication channels being used. Video conferencing platforms like Zoom, for instance, weren’t commonly adopted by businesses until we needed an alternative solution for interpersonal sales conversations without being in person.

No matter what sales reps are adjusting to, they must foresee the changes and prepare themselves to adapt accordingly. Preparation could include participating in sales training for a new product, enrolling in courses for a new software tool your business adopted, or developing techniques to adhere to a new buyer preference you’re seeing in your market.

6. Collaboration

Like most jobs in any industry, salespeople must work well with others on tasks and projects while managing business processes. There are plenty of situations in sales where a deal or account is so large that multiple reps need to collaborate on it. It’s also common to have other specialists involved in an opportunity. For example, a rep might need to have a company attorney review or draft proposals prior to sending them for prospect review.

Even after a sale is made during onboarding, account executives often pass off the new client to an account manager to become the new point of contact. Regardless of the task or time, it is valuable to collaborate with your team and use your specialty knowledge to assist others with their job functions.

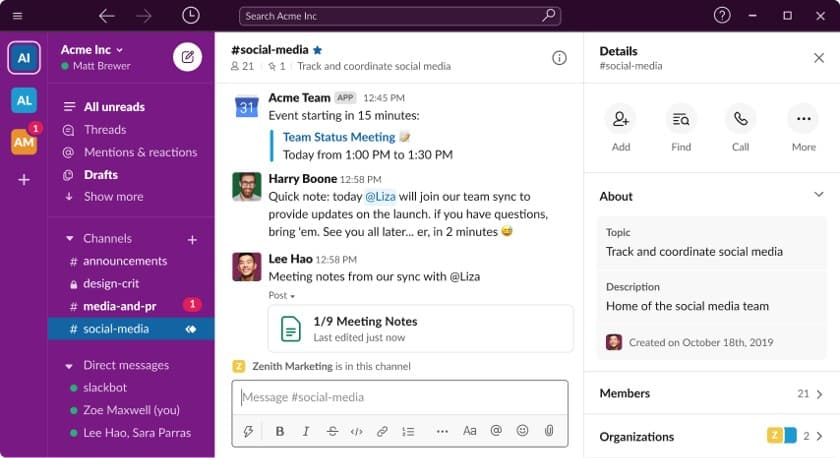

Many collaboration capabilities are dictated by the tools and culture you have in place. If you encourage and incentivize your teams to work together while also implementing the right technology and systems, team-based workflows will get done efficiently and with minimal conflict.

7. Decisiveness

Leaders aren’t the only people who need to be decisive. Many sales reps work independently and have circumstances around sales opportunities that may require a firm decision. For instance, if you’re in a role where you can provide a certain percentage of discounted products or services per quarter, you need to promptly make tough decisions on which deals to propose discounts for and when.

Without being decisive in those kinds of situations, you risk losing out to a competitor. This skill tends to come naturally to most executives, directors, and managers who need to make critical decisions without taking too much time. Your experience in the role can also help develop this skill since procrastination, which is typically rooted from the fear of the unknown or failure, is minimized if you’ve been in similar situations before.

8. Time Management

Sales reps are specialists who should spend most of their time conducting discovery meetings, prospecting, and client-facing—the actual selling part of the job. Unfortunately, estimates show much of their time is actually spent elsewhere. For example, 32% of reps spend between 11% and 20% of their time each week doing paperwork, 37% spend 6% to 10% of their time in internal meetings, and 41% spend 6% to 10% in sales training.

These findings imply that reps either don’t have tools or systems to manage these other tasks effectively and/or they are poorly managing their time each week. Assuming a sales operation has the automaton and enablement tools in place to hit peak productivity, it ends up coming down to each individual rep putting aside the time to complete all their tasks without any distractions and focusing their efforts on the most important tasks at that moment.

Time management is often something you can be trained or coached on—especially if a sales team leader has discovered tricks to complete tasks faster. Many experienced salespeople also develop systems that work for them to ensure they are productive. For instance, they may use quieter days like Friday afternoons to catch up on data entry and paperwork and the days prior for connecting with leads.

9. Persuasiveness

Last but certainly not least, sales reps must be able to sell through the art of persuasion. It’s important to clarify that being persuasive doesn’t mean convincing someone to purchase something that doesn’t meet their needs. It’s convincing them to see the problems your solution can fix and expressing how your unique selling proposition makes your product or service the best fit.

Persuasion also involves convincing your prospect to consider a handful of options and alternatives. For instance, a potential customer may look for the cheapest product or service package you offer. In this scenario, you need to enlighten them to check out other options you know would better suit their needs—even though they seemed set on prioritizing the lowest price.

This skill is often developed naturally as you become experienced in sales. There are also training courses such as SPIN selling, which teaches you to use eye-opening questions to reduce objections and increase value for the customer, as well as Richardson’s Consultative Selling Skills course, which focuses on diagnosing and identifying solutions to become more persuasive and effective in your sales calls.

Hard Sales Skills vs Soft Sales Skills

The nature of soft sales skills makes them more difficult to evaluate than hard sales skills. This is because soft skills are general characteristics that involve how one interacts with others, while hard skills are more technical, job-specific, and are typically easier to identify on a resume or measure through day-to-day performance.

For example, software developers need to have programming skills, such as knowing one or two coding languages. These are considered hard skills while their ability to effectively collaborate on development projects would be a soft skill.

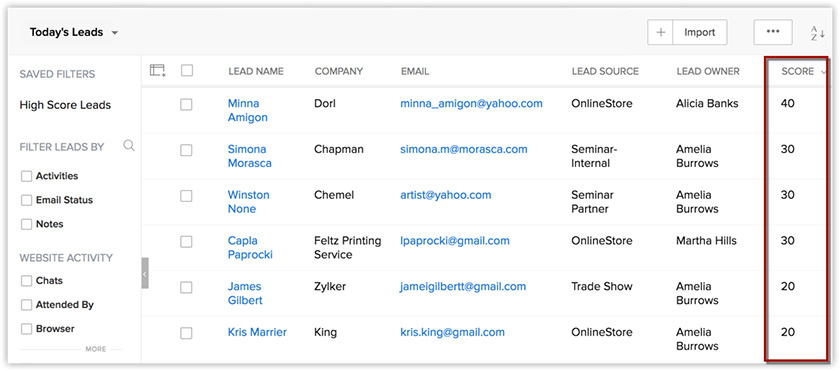

In the sales world, a rep’s understanding of the sales process, the products they’re selling, and the technical knowledge of using a customer relationship management (CRM) system are hard skills required to get them the job in the first place. However, everything involving professional relationship building would fall under the soft skills of sales reps, which is why they also need to be included in professional development plans or training programs.

Why Reps Need Soft Sales Skills

While there are tons of interpersonal traits involved in connecting with others, good communication skills are essential for both sales reps and those in sales management. The ability to effectively exchange information ensures a smooth process, whether referring to the sales pipeline or completing tasks with other team members. Having solid communication capabilities includes filtering and providing information to others in a clear way as well as actively listening to understand another person’s point of view.

In sales, communication is needed to explain your unique selling proposition, describe how your solution works, affirm your ability to solve your lead’s problems, and adequately address questions presented by a potential customer. In doing this, you should filter information that is unnecessary or would be considered “fluff” to the recipient. Additionally, the effort in remaining in contact and providing frequent progress updates is a huge trait for this skill.

How to Develop Soft Sales Skills

To develop this sales soft skill, you or your reps can take general communication courses and ones specific to sales. You can also reinforce good communication habits by carving out time in your schedule to send email updates to prospects on where you are with them. Also, during conversations, be sure to listen for information and not just to respond—commonly known as active listening.

Bottom Line

Soft skills for sales reps are the more subjective ones that are tough to measure but play a significant role in connecting and building rapport with prospects. These include social and personality attributes that allow them to work well with others, understand different points of view, and communicate effectively. Through these skills, salespeople create more trusting relationships, solve problems more efficiently, and ultimately close more sales deals.